7.2 Attraction and retention

Employees within Australia, and across the world, have changing expectations of what they want from work and how they will work. The traditional operating models of the APS are being challenged and technological advances are requiring the service to adapt rapidly to the future of work. Employees have a new benchmark for the workplace experience and want more flexibility, more inclusive workplaces and a greater sense of purpose.

The Future of Work Sub-committee is exploring push and pull factors in attracting and retaining critical skills and talent for the APS. This work has drawn insights from across the service, for example:

- just over half (53%) of all new recruits into the service have had previous APS experience [49]

- the APS is more likely to recruit from within for senior roles

- across all jobs, the APS advertises for more positions in Canberra than other employers nationally.

These recruitment characteristics pose significant risk in attracting and retaining the right workforce skills and capabilities. As a consequence:

- the APS nearly always appoints or promotes from within for EL and SES levels

- where APS employees are located is changing, however the APS remains Canberra-centric for senior roles

- recruitment does not target in-demand occupations where they are located (that is, in New South Wales, Victoria, and Queensland).

This means the APS is missing out on opportunities to source talent, especially for in- demand occupations. It also risks not better reflecting the diversity of the community it serves if these narrow recruitment actions prevail.

Attraction#

The Future of Work Sub-committee builds on the priorities in the APS Workforce Strategy 2025, primarily supporting its first action area of ‘attract, build and retain skills, expertise and talent’. Specifically, the sub-committee has explored trends in APS hiring practices and identified areas for uplift.

The APS surveyed a number of new APS employees to paint a picture of factors that attracted them to the service and how their expectations had been met. This survey drew on approximately 1,600 APS employees who started over the course of 12 months from February 2021. Findings suggest that most new recruits find jobs through the APSJobs website (49%) or by word of mouth (20%). A large proportion of new starters indicate the hiring process could be improved (65%), in areas such as timeliness and communication.[50]

These new starter experiences and insights also intersect with recruitment practices that are cumbersome, inefficient and characterised by a highly fragmented approach across the APS. Recruitment processes are lengthy, with a sample of three extra-large APS agencies indicating the average time to merit pool selection was 69 days, compared to the NSW public service reporting 39 days and the Australian Human Resources Institute reporting an average of 33 days for the private sector.[51] This means the APS is often losing the best talent before even getting that talent in the door.

The APS can also do more to ensure consistency in key recruitment information and approach across agencies to attract talent. Advertising of similar APS jobs, often at the same level, can vary significantly in terms of recruitment forms, advertising approach, position descriptions and requirements of candidates throughout the selection process. Refining a One APS approach to recruitment, without an ‘insider’ bias, will better position the APS as an employer of choice at the forefront when prospective employees are researching and applying for positions.

A One APS approach to recruitment can also deliver transparent, efficient and consistent recruitment outcomes by:

- reducing timeframes and sharing merit lists across agencies

- designing best-practice recruitment and selection options that satisfy the merit principle but also provide for flexibility and diversity

- enhancing the internal marketing of the APS and reducing reliance on recruitment agencies and labour hire firms

- improving the candidate experience and APS brand and

- securing access to new talent pools through further flexibility in employment arrangements.

Retention#

The drivers of retention in the APS are multi-faceted. Respondents to the 2022 APS Employee Census most commonly said their reasons for staying in the APS were job security (69%), the type and nature of the work they were doing (51%) and non-monetary employment conditions (51%). The drivers of employee retention, however, are not one- dimensional. For example, the type and nature of work was more likely to be important to more senior employees and employees in strategic policy roles whereas remuneration was more commonly cited by those in communications and marketing roles.

The APS is also beginning to better understand the top attrition drivers across the service. Those planning to leave the service most commonly cite that they:

- can receive a higher salary elsewhere

- are seeking different work or a career change

- lack future career opportunities within their agency.

Separation rates across the APS substantially declined in 2019–20 with the emergence of COVID-19 and they remained low over 2020–21. In 2021–22, however, separation rates rose to levels above those seen before the pandemic. More generally, a reduction in the Australian unemployment rate (indicating a tighter labour market) is historically associated with an increase in the APS separation rate. If Australia’s unemployment rate remains very low, the APS separation rate may continue to be elevated through to the end of 2024.

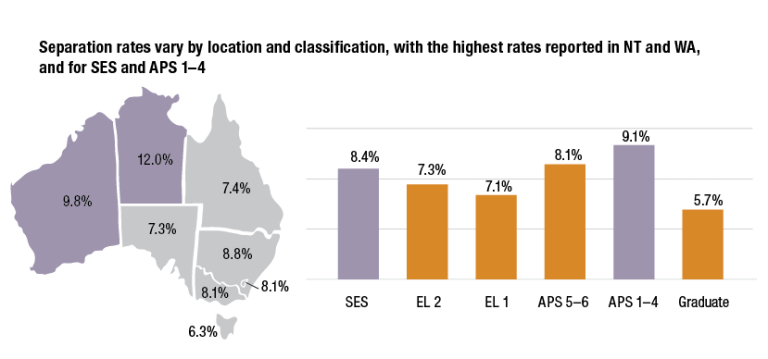

Separation rates vary by location and classification, with the highest rates reported in the Northern Territory and Western Australia, and for SES and APS 1 to APS 4 employees (Figure 7.1). Separation rates are also relatively high among APS staff with less than two years of service (12.2%), approximately twice that of employees who have worked in the service for 10 to 15 years (6.2%).

Figure 7.1: APS separation rates by location and by classification level (2022)

Source: APSED

Developing meaningful career pathways is an emerging focus for the APS to attract and retain top talent, particularly for critical roles. Strategic workforce tools can be deployed to support career pathways, including mobility, having formal approaches in place to support career development and adopting a One APS approach to skill investment.

Offering APS employees opportunities to work closer to home and their local communities is also a core focus. Public servants of the future do not necessarily have to move to Canberra to have a meaningful and purposeful career with the APS.

In-demand occupations#

The labour market for particular skills is increasingly competitive. On the demand side, the Australian economy has experienced rebounding gross domestic product growth coming out of COVID-19, which has meant demand for labour is strong across the nation.[52] On the supply side, disruption to skilled migration through the pandemic has hit some occupations particularly hard, exacerbating competition for existing workers. This is particularly true in fields such as ICT and accounting which have a high reliance on skilled migration. In 2020–21, there were only 5,509 ICT and software related skilled migrants, compared to a nine-year annual average of 9,467. For general and management accountant skilled migrants, there were only 1,062 migrants compared to nine-year annual average of 5,003.[53] This results in rising wages for these occupations in the private sector, which puts pressure on APS wage competitiveness for those roles. For APS employees working within these in-demand occupations, receiving a higher salary elsewhere is of increasing importance in their reasons for wanting to leave the APS.[54]

These trends are impacting the ability of APS agencies to fill roles in some in-demand occupations, such as in the accounting, data analysis and science, ICT, engineering and security, program and project management, and legal fields. Agencies are facing acute worker shortages across these job families as well as in HR (Figure 7.2).

Figure 7.2: Proportion of agencies experiencing skills or labour shortages in each job in the APS Job Family Framework (2022)

Source: 2022 APS Agency Survey

Tight labour market conditions are expected to eventually loosen. At the Jobs and Skills Summit, the Australian Government agreed to increase Australia’s permanent migration to 195,000 places in 2022–23 to help ease widespread, critical workforce shortages.[55] Gross domestic product growth is also expected to return to long-term trends, with the Reserve

Bank of Australia forecasting that it will return to a growth rate of 1.8% by December 2023.[56] Forecasts of growth rates for in-demand occupations indicate robust growth (Table 7.1), which will see wage pressures reduce.

Table 7.1: National Skills Commission 5-year forecast growth rates for in-demand occupations

| In-demand occupations | National workforce future growth (5 years to November 2026)(%) |

| Database and Data Administration Officer | 38.9 |

| ICT/Cyber Security Officer | 38.9 |

| Data Engineer | 27.0 |

| Software Engineer | 27.0 |

| Lawyer | 21.0 |

| IT Architect | 12.9 |

| Data Miner/Data Scientist | 11.0 |

| Program and Project Administrators (for example, Program Support Officer, Project Support Officer) | 9.3 |

| General Accountant | 9.2 |

| Overall | 9.1 |

Note: National Skills Commission unit groups have been mapped to job roles in the APS Job Family Framework.

Source: National Skills Commission Labour Market Insights Occupation Profiles 2022.

Footnotes#

[49] 2022 Future of Work Taskforce Survey for APS New Starters.

[50] 2022 Future of Work Taskforce Survey for APS New Starters.

[51] APSC analysis based on 2020 and 2021 recruitment system data provided by three extra-large APS agencies.

[52] Reserve Bank of Australia, Statement on Monetary Policy: August 2022 - external site, n.d., 2022.

[53] Department of Home Affairs, Permanent Migration Program (Skilled & Family) Outcomes Snapshot Annual Statistics: Program years 2011–12 to 2020–21 - external site, n.d.

[54] 2022 APS Employee Census.

[55] Australian Government, Jobs + Skills Summit: Outcomes - external site, 1–2 September 2022.

[56] Reserve Bank of Australia, Forecast Table: August 2022 - external site, n.d., 2022.