Chapter 2: Remuneration components

The key remuneration components covered by this report are Base Salary, Total Remuneration Package (TRP), Total Reward (TR) and allowances.

Base salary

Base salary is an employee’s full time equivalent annualised salary. It includes salary sacrifice amounts such as pre-tax employee superannuation contributions made via salary sacrifice arrangements.

Total remuneration package

TRP incorporates Base Salary plus benefits. Benefits include: employer superannuation contribution, motor vehicle cost, cash in lieu of a motor vehicle, motor vehicle parking, personal benefits and other supplementary payments.

Total reward

TR represents the full remuneration amount for each employee, less allowances. TR is the sum of TRP (Base Salary plus benefits) plus bonuses. Bonuses include: individual performance, retention, productivity, sign-on, performance by the employee’s group or whole agency and fixed top-of-salary-range payments.

Allowances

Allowances are payments that sit outside of TR as TR plus allowances (TRA). They cover payments for working conditions, qualifications and work-related expenses. The availability of, and eligibility for, allowances depends on specific conditions provided under an employee’s employment instrument and particular circumstances of positions.

Movement in remuneration components

Remuneration movements are affected by a number of factors such as general wage increases, increment progression through salary scales, promotions, engagements and transfers between agencies.

The 31 December 2021 APS Employment Data Release reported that 28.4% of ongoing employees took up initial employment, transferred at level to another agency or were promoted during 2021. The majority of these were newly engaged or promoted employees. High numbers of engagements and promotions can affect median values as newly engaged or promoted employees tend to commence on salaries at the bottom of their salary scale.

Differences in agencies’ salary scales may also impact the data where there is significant movement of employees between agencies or changing recruitment patterns between agencies.

The population of each classification can affect median percentage changes. A change in headcount can easily shift the median value in a salary scale for classifications with a small population such as the APS 1, APS 2, Graduate and SES levels.

Large agencies have a significant impact on remuneration movement. Services Australia, the Australian Taxation Office, the Department of Defence and the Department of Home Affairs make up 53% of employees covered in this report. Wage increases and recruitment patterns at these agencies can have a substantial impact on median percentage changes.

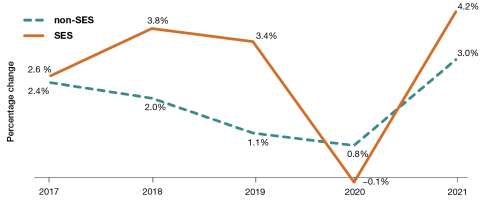

Figure 2.1 shows the annual proportional change in weighted median Base Salaries for non-SES and SES employees over the last five years. There were significant increases in non-SES and SES Base Salaries in 2021. This follows very low or negative movement in 2020 due the deferral of remuneration increases.

Figure 2.1 Percentage change in weighted median Base Salary by classification group 2017 to 2021

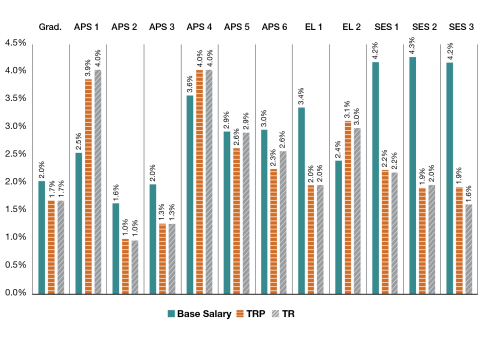

Figure 2.2 shows movement in median remuneration between 2020 and 2021 for Base Salary, TRP and TR. There were increases across all remuneration components and classifications.

Movement in SES TRP and TR was more modest than SES Base Salary movement, suggesting some repackaging of entitlements into Base Salaries.

Figure 2.2 Percentage change in median remuneration components, 2020 to 2021