Chapter 4: Total remuneration package

Total Remuneration Package (TRP) covers Base Salary plus benefits. It excludes bonuses which are included in Total Reward (TR) and shift and overtime payments.

Benefits include:

- employer superannuation contribution

- motor vehicle cost/cash in lieu of motor vehicle

- motor vehicle parking

- any other benefits and supplementary payments.

Superannuation is the main component captured in TRP above Base Salary.

The weighted median TRP increase from 2020 to 2021 was 2.5% for the whole of the APS. This reflects weighted median increases of 2.6% for non-SES employees and 2.2% for SES (see Appendix A.3: Table 1b).

Total Remuneration Package movement by classification

Table 4.1 shows percentage changes in median TRP by classification from 2020 to 2021. The median TRP increased across all classifications.

The highest median increase was 4% at the APS 4 classification. The lowest median increase was 1% at the APS 2 classification.

SES TRP increases were consistently lower than SES Base Salary increases. Median TRP for the SES 1 classification increased by 2.2% and by 1.9% for both the SES 2 and SES 3 classifications.

Table 4.1 Total Remuneration Package by classification, 2020 and 2021

| P5 | Q1 | Median | % change | Q3 | P95 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | 2021 | ||

| Grad | $69,330 | $72,002 | $73,287 | $74,228 | $76,229 | $77,514 | 1.7% | $78,438 | $80,682 | $82,973 | $84,905 |

| APS 1 | $52,714 | $54,724 | $57,063 | $57,673 | $59,430 | $61,729 | 3.9% | $61,991 | $63,695 | $68,047 | $66,898 |

| APS 2 | $57,695 | $59,796 | $62,293 | $62,980 | $66,340 | $67,000 | 1.0% | $70,093 | $71,932 | $73,540 | $75,460 |

| APS 3 | $68,661 | $69,163 | $72,491 | $71,685 | $76,524 | $77,494 | 1.3% | $79,241 | $80,202 | $85,072 | $86,297 |

| APS 4 | $77,135 | $79,528 | $82,703 | $84,028 | $84,787 | $88,212 | 4.0% | $87,799 | $90,768 | $91,365 | $94,077 |

| APS 5 | $85,606 | $88,034 | $90,497 | $92,181 | $93,021 | $95,468 | 2.6% | $96,280 | $98,359 | $100,233 | $102,416 |

| APS 6 | $96,249 | $98,336 | $104,277 | $105,923 | $108,705 | $111,154 | 2.3% | $112,796 | $115,012 | $118,474 | $121,471 |

| EL 1 | $122,126 | $124,136 | $131,190 | $134,224 | $136,598 | $139,277 | 2.0% | $139,730 | $143,712 | $148,397 | $151,877 |

| EL 2 | $147,058 | $150,475 | $162,388 | $165,561 | $170,148 | $175,452 | 3.1% | $176,643 | $181,452 | $196,129 | $200,669 |

| SES 1 | $225,903 | $230,995 | $241,929 | $246,197 | $254,739 | $260,432 | 2.2% | $266,756 | $272,584 | $289,204 | $295,837 |

| SES 2 | $289,109 | $296,235 | $309,475 | $316,139 | $322,733 | $328,890 | 1.9% | $341,927 | $347,178 | $379,438 | $380,007 |

| SES 3 | $391,499 | $387,816 | $415,117 | $421,772 | $439,777 | $448,253 | 1.9% | $459,078 | $467,415 | $530,173 | $512,612 |

Total Remuneration Package trends

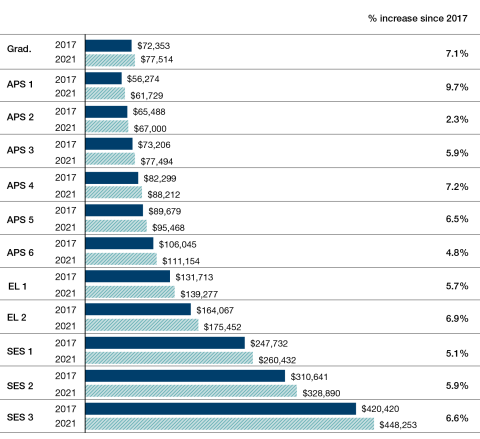

Figure 4.1 presents a comparison of median TRP by classification in 2017 and 2021. These are nominal figures, not adjusted for inflation. Increases ranged from 2.3% at the APS 2 classification to 9.7% at the APS 1 classification. Movement in SES TRP was lower than movement in SES Base Salaries over the period. This reflects repackaging of remuneration components in previous years.

Figure 4.1 Median Total Remuneration Package by classification, 2017 and 2021

Total Remuneration Package range

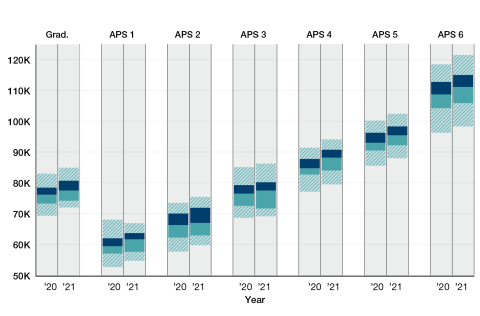

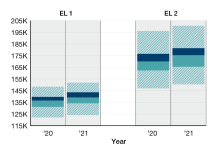

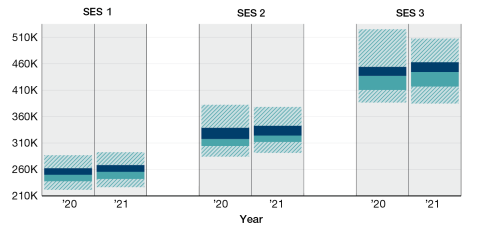

Figures 4.2a to 4.2c show changes in TRP ranges by classification from 2020 to 2021. See Appendix A.1 for notes on interpreting these figures.

There were increases across all classifications at most percentiles. For non-SES classifications, percentile movements were similar to Base Salary.

Figure 4.2a Total Remuneration Package range by classification, 2020 and 2021 (Graduate, APS 1-6)

Figure 4.2b Total Remuneration Package range by classification, 2020 and 2021 (ELs)

SES classifications had lower increases across all percentiles compared to SES Base Salary movement. At the SES 3 level, there was a 3% decrease at the 95th percentile. This is due to an increase in headcount which shifted the value of the 95th percentile. Given the very small population, SES 3 percentile values are subject to greater variations than other classifications.

Figure 4.2c Total Remuneration Package range by classification, 2020 and 2021 (SES)

Superannuation

Employer superannuation contribution is the main component captured in TRP after Base Salary.

APS employee superannuation fund membership has been reported across four categories:

- Public Sector Superannuation Accumulation Plan (PSSAP)

- Public Sector Superannuation Scheme (PSS)

- Commonwealth Superannuation Scheme (CSS)

- ‘Other’.

For most of the coverage period of this report, the PSSAP was the default fund assigned to employees engaged under the Public Service Act 1999 who did not nominate an alternative complying superannuation fund or valid retirement savings account. The employer contribution rate for the PSSAP is 15.4% of superannuation salary.

The use of PSSAP as the automatic default fund changed from November 2021. The Your Future, Your Super reforms introduced at that time require agencies to make superannuation contributions to an employee’s pre-existing ‘stapled’ fund (where one exists) rather than a default Commonwealth fund, unless the employee chooses otherwise. The full impact of this legislation will be more apparent in the 2022 APS Remuneration Report.

The PSS and CSS funds were closed to new entrants on 1 July 2005 and 1 July 1990 respectively.

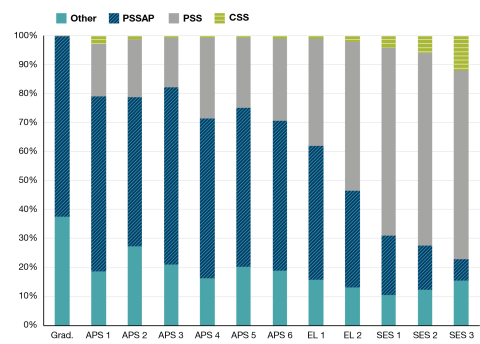

Figure 4.3 shows that the PSSAP had the highest membership up to the EL1 level (see Appendix A.3: Table 8). This is consistent with 15.4% representing the median employer superannuation contribution rate up to and including EL 1 (see Appendix A.3: Table 7).

PSS membership remains more common for employees at or above the EL 2 classification. This is consistent with the typical longer length of service for these individuals making them eligible for enrolment in the PSS prior to its closure to new members in 2005.

Figure 4.3 Proportion of employees in superannuation fund by classification, 2021

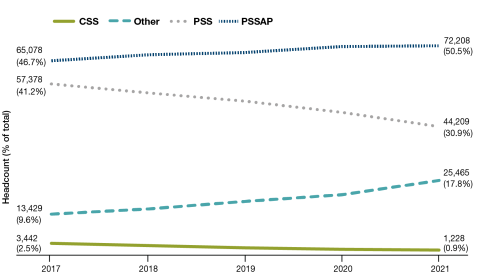

Figure 4.4 shows a continued overall decrease in PSS and CSS membership as members of these funds leave the APS. While PSSAP membership remained stable from 2020 to 2021 the proportion of employees in ‘Other’ superannuation funds increased.

Membership in ‘Other’ funds has increased over the last five years from 9.6% of employees in 2017 to 17.8% of employees in 2021. This reflects increased use of non-Commonwealth superannuation funds, possibly retained from prior employment. Membership in ‘Other’ funds was most evident at the Graduate classification where 37.7% of employees belonged to an ‘Other’ fund.

Figure 4.4 Headcount of employees in superannuation fund (percentage of total)