Chapter 9: Employment instruments and Individual Flexibility Arrangements

Primary employment instruments

A primary employment instrument is a comprehensive arrangement used to set the majority of the terms and conditions of an employee.

Employees within the APS have their employment terms and conditions set by one of the following primary employment instruments:

- Enterprise Agreements (EA) [1][2]

- Public Service Act Determinations (s24 (1) and (3)) (PSAD)

- Common Law Agreements (CLA)

- Australian Workplace Agreements (AWA).

From 2020 to 2021 the number of employees covered by an EA increased from 105,232 to 110,697. The increase primarily reflects increased headcounts in agencies. However, one large agency established in 2019 made an EA for the first time in 2021. The overall proportion of employees covered by an EA remained at 77%.

While most non-SES employees had the majority of their terms and conditions set in an EA, a significant proportion had the majority of their terms and conditions set in a PSAD. Over 90% of these were employees of Services Australia who had the terms and conditions of a former EA preserved under a s.24(3) determination made under the Public Service Act 1999 (PS Act), following abolition of the Department of Human Services.

Only 0.5% of employees were covered by a CLA or AWA that operated as the primary employment instrument.

Table 9.1 provides a breakdown by classification of primary employment instrument coverage.

Table 9.1 Employees by employment instrument and classification, 2021

| Primary Employment Instrument | ||||

|---|---|---|---|---|

| Classification | AWA | CLA | EA | PSAD |

| Grad | 0 | 0 | 1,566 | 93 |

| APS 1 | 0 | 0 | 228 | 65 |

| APS 2 | 0 | 0 | 1,930 | 63 |

| APS 3 | 0 | 6 | 8,064 | 4,558 |

| APS 4 | 0 | 45 | 14,050 | 11,667 |

| APS 5 | 0 | 50 | 17,633 | 3,518 |

| APS 6 | 0 | 72 | 28,731 | 5,329 |

| EL 1 | 3 | 90 | 26,613 | 2,908 |

| EL 2 | 0 | 58 | 11,859 | 1,052 |

| SES 1 | 5 | 249 | 18 | 1,832 |

| SES 2 | 3 | 73 | 5 | 538 |

| SES 3 | 0 | 14 | 0 | 122 |

| All employees | 11 | 657 | 110,697 | 31,745 |

Public Service Act Determinations providing wage increases

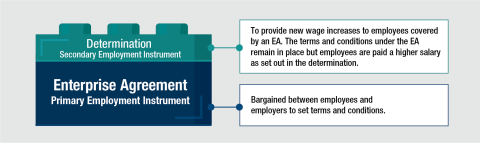

Australian Government workplace relations policies have allowed agencies to adopt secondary employment instruments to supplement a primary employment instrument where this suits business needs.

Many agencies have put in place a s.24(1) determination made under the PS Act to provide wage increases on top of an EA that has passed its nominal expiry date (see Figure 9.1). Agencies that were satisfied with the operation of an existing EA and gained the support of employees, have been able to provide wage increases to non-SES employees through a determination instead of bargaining a new EA. As at 31 December 2021, 65 agencies including Services Australia[3], the Australian Taxation Office, the Department of Defence and the Department of Home Affairs had these type of arrangements in place. This represents over 100,000 employees, or 71% of the APS workforce.

Figure 9.1 Supplementation of salaries in an Enterprise Agreement using a determination

Individual Flexibility Arrangements

A small percentage (2.2%) of employees have additional terms and conditions provided under a secondary agreement known as an Individual Flexibility Arrangement (IFA). Table 9.2 shows that 74.7% of employees using an IFA were at the EL 1 or EL 2 classification.

An IFA can be used to vary the effect of an EA or award on an individual basis where agreed between the employer and employee as long as the employee is better off overall. An IFA can provide for a range of conditions such as pay and allowances, leave, income maintenance, flexible working arrangements, superannuation and subscriptions or memberships. A single IFA may cover multiple arrangements.

The majority of IFAs (88.8%) were used to provide pay and allowances. The second highest usage was for flexible working arrangements (5.9%).

Table 9.2 Number of employees with an IFA and distribution by classification, 2021[4]

| Classification | Headcount | Percentage |

|---|---|---|

| Grad | 3 | 0.1% |

| APS 1 | 0 | 0.0% |

| APS 2 | 2 | 0.1% |

| APS 3 | 8 | 0.3% |

| APS 4 | 144 | 4.5% |

| APS 5 | 132 | 4.2% |

| APS 6 | 516 | 16.2% |

| EL 1 | 1,015 | 31.9% |

| EL 2 | 1,360 | 42.8% |

| SES 1 | 0 | 0.0% |

| SES 2 | 0 | 0.0% |

| SES 3 | 0 | 0.0% |

| All employees | 3180 | 100% |

[1] Includes agencies using a Public Service Act Determination for the purposes of wage increases while continuing to provide other terms and conditions through an Enterprise Agreement that has passed its nominal expiry date.

[2] As at 31 December 2021, the Department of Home Affairs was covered by a Workplace Determination established by the Fair Work Commission. It is included under Enterprise Agreements for the purposes of this report.

[3] Services Australia put a s.24(1) determination in place as a secondary employment instrument to provide wage increases on top of a s.24(3) determination that preserved a former EA.

[4] These numbers do not include IFAs made under abolished enterprise agreements that have been preserved through the operation of a s24(3) determination made under the PS Act.